The downward history of UVXY can be attributed to three main factors; using a benchmark derived from futures in contango, beta slippage, and the reverting nature of volatility itself.

Futures in Contango

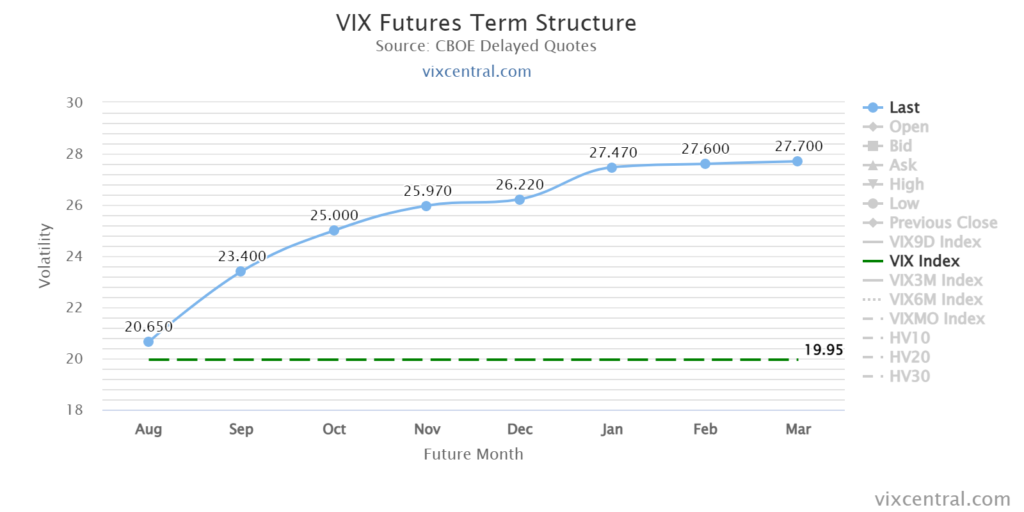

Contango is the main driver of UVXY’s downside price path over the longer term. The daily roll from front month contract to second month contract, where the front month is sold at a lower price than the second month, creates ever-renew pressure to the downside.

This mix of contracts makes up the S&P 500 VIX Short-Term Futures Index which UVXY moves relative to each day. Only when the futures move into backwardation is this pressure temporarily relieved.

Beta Slippage

Also called volatility drag, this is a compounding effect in which each day resets a price level (NAV) that changes in the benchmark are applied to. Calculating the degree of this impact is highly dependent on the period you choose to measure (price levels for starting and ending dates) though I find that using distant dates where the benchmark SPVXSP.ID had approximately the same value. Like backwardation, this affect can work in both directions but in the overwhelming majority of days, this is pulling UVXY’s price lower.

Reversion to the Mean

As the VIX index represents the value traders place on SPX options, they have a tendency to find historical levels. When VIX spikes, it is only a matter of time before it drops back down to long term averages. As VIX drops, so do the futures that track it which necessitates a drop in UVXY. Unlike the other two factors there isn’t exactly a reverse condition of reversion. While it could be argued that an exceptionally low VIX will certainly rise in the future to align to long term averages, the reality is that the contango factor is enlarged with a very low VIX, essentially negating the impact of an upward reversion.